Can Japanese afford costly new cancer drugs?

Mutsumi Murakami

On May 15th in 2019, a top news headline on the front page of a national newspaper’s evening edition was about a new drug CAR-T (Kymriah).(1) The news article reported that the Central Social Health Insurance Council at the Ministry of Health, Labour and Welfare (MHLW) decided to cover this new drug through the Japanese Social Health Insurance (SHI) system. According to the news article, the drug will treat patients with Leukemia and Diffuse large B-cell lymphoma, and the price of this drug will be ¥33,493,407 ($304,486, calculated US$1=¥110). CAR-T became the most expensive approved drug on a per one-time use basis. The article added that the SHI would start covering the new drug from May 22nd.

When I read this article, I felt relieved and thought that my life could be extended with this new drug because I have a long medical history of fighting with diffuse large B -cell lymphoma. My lymphoma has reoccurred twice since I was diagnosed for the first time 16 years ago. If it reoccurs, I thought the next treatment option would be hematopoietic stem cell transplantation, which I heard was very tough, and sometimes patients died during these treatments. Now I might have another choice with this new treatment using CAR-T, and I felt very fortunate. On the other hand, anxiety has arisen in my mind. How much do I have to pay for this expensive drug to extend my life? If the treatment continues, can I afford it? I assumed that I was not the only one who worries about the payment of these effective but expensive drugs. There should not be a small number of people who have to give up a costly cancer treatment because they can’t afford it.

After reading this article, I started to search for other newspaper articles that focus on the payment of the new cancer drug. Soon afterward, I came across an article that reported the medical payment process.(2) The article described the story of two men who suffered from the burden of the out of pocket medical bills which they paid for their cancer treatments. One man in his 60’s decided to stop treatment with a new and expensive drug called “immune checkpoint blockade.” He ended the treatment in the middle of the term because his monthly medical payments had been around ¥100,000 even after using the system called “Catastrophic coverage.” It is a system for reimbursement within the SHI in Japan when the patients’ out of pocket medical payments pass a certain amount each month. In the article, the oncologist said that the treatment periods had become longer than they used to be for new drugs, such as molecularly-targeted drugs and immune checkpoint blockades. The oncologist further noted that it is difficult to discern when patients should cease treatments.

What is Catastrophic Coverage?

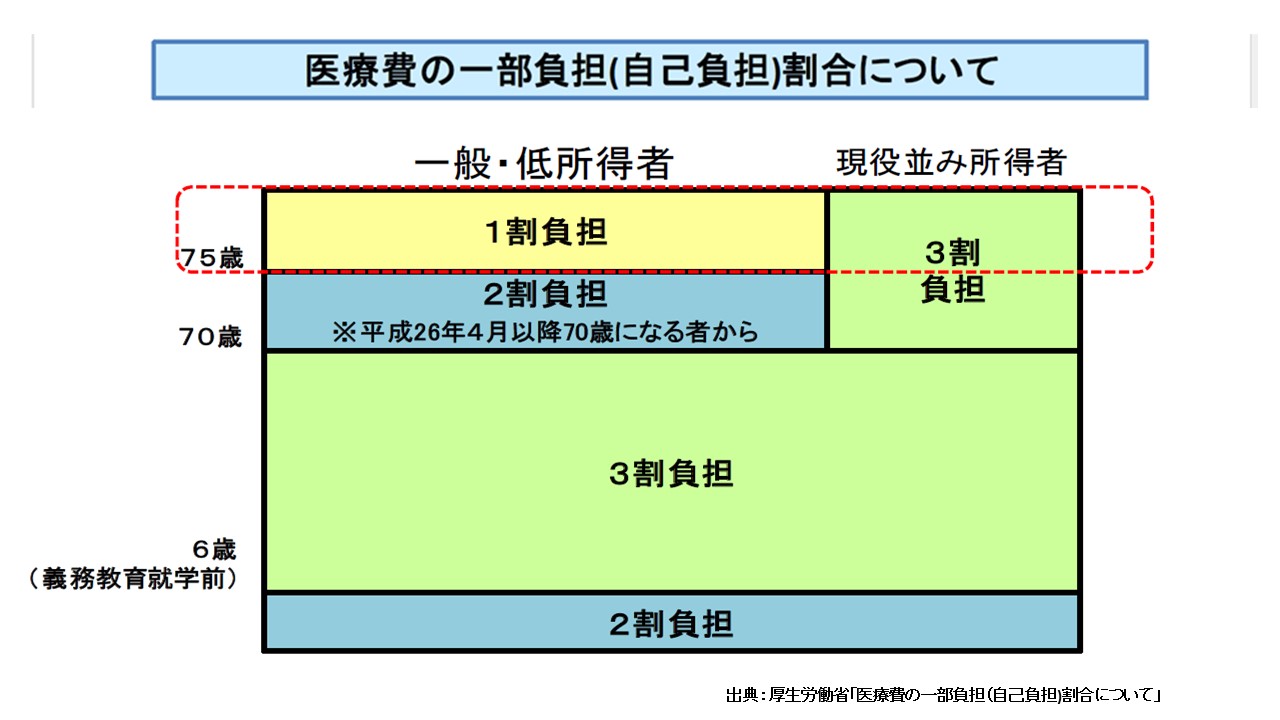

In Japan, 70% of medical costs are covered by the SHI, and 30% is paid out of pocket by patients (from 1st grade of elementary school to 69 years old and wealthy elderly)-see Table1.(3) The Catastrophic coverage system applies to patients’ out of pocket payments. When the aggregate amount of payment which patients pay at hospitals or pharmacies in one month (from the beginning to the end of a calendar month) exceeds a certain amount, then payment over the threshold will be reimbursed to the patients later if they apply for the insurance.

Table1: Ratio of copayment for Medical Cost

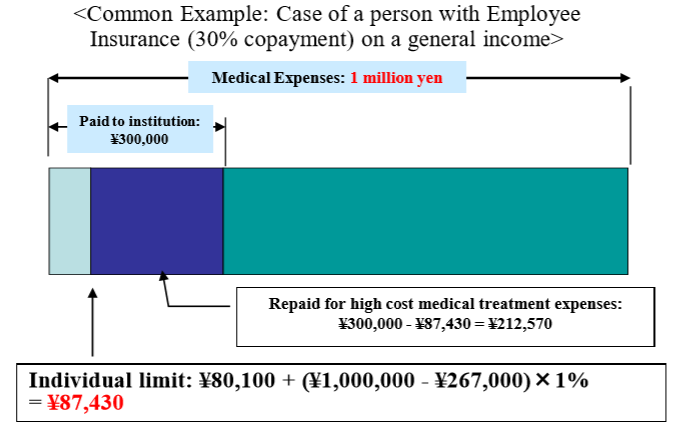

The cap for a patient’s co-payment of a medical bill is dependent upon a patient’s annual income. For example, if a patient is under 70 years old, and has an annual income between ¥370,000 and ¥770,000, and suppose that his medical expenses in a given month are ¥1,000,000, then his co-payment is initially¥300,000. However, ¥212,570 will be reimbursed to the patient if he applies for his insurance. This means that the patient’s co-payment for that month would be ¥87,430 -see Table2.(4)

Table2: Catastrophic Coverage in SHI(Source:Ministry of Health,Labour and Welfare)

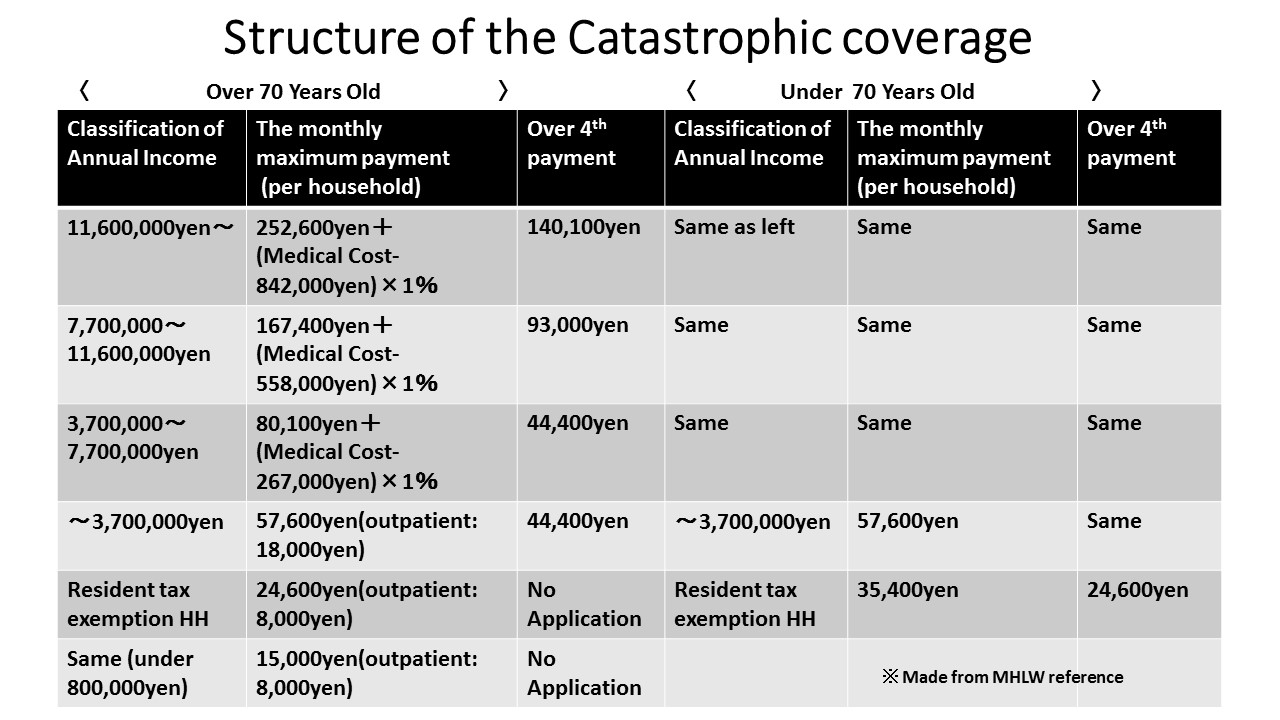

The structure of the Catastrophic coverage system is described further in Table 3 below.(5)The classification of an individual’s annual income is separated into six sections for a person over 70 years old and five sections for a person under 70 years old. As an example, let’s calculate the out of pocket payment for new drug CAR-T. If your classification of annual income is between ¥3,700,000 and ¥7,700,000, then your total payment will be ¥412,364 after you apply for the Catastrophic coverage. The calculation is as follows; ¥80,100 + (¥33,493,407-¥267,000 ) × 1%= ¥412,364. CAR-T will be used only one time; therefore, you will finish the payment if you don’t have additional treatment or care.

Table3: Structure of Catastrophic Coverage

Revision of the Catastrophic Coverage System

The Japanese Catastrophic coverage system started in 1973. The cap on the out of pocket payment to patients at that time was ¥30,000. Since then, the system has been revised multiple times over the years. From 2015, the classification of patients under 70 years old was subdivided. As a result, the burden of higher- income patients increased.(6) For patients over 70 years old, the cap of the payment hadn’t changed since 2006; however, the cost of the Catastrophic coverage has increased. Then in 2016, the Health Insurance Committee of Social Security Council in the MHLW started a discussion to revise the system.(7) At that committee meeting, the MHLW presented the data of the Catastrophic coverage costs between 2004 to 2013. In 2013, the total cost of the Catastrophic coverage was ¥2.2 trillion. The cost increased 1.58 times within that ten years. With this result,the MHLW revised the structure of patients over 70 years old at the end of 2016 and applied the changes in 2017 and 2018.(8)

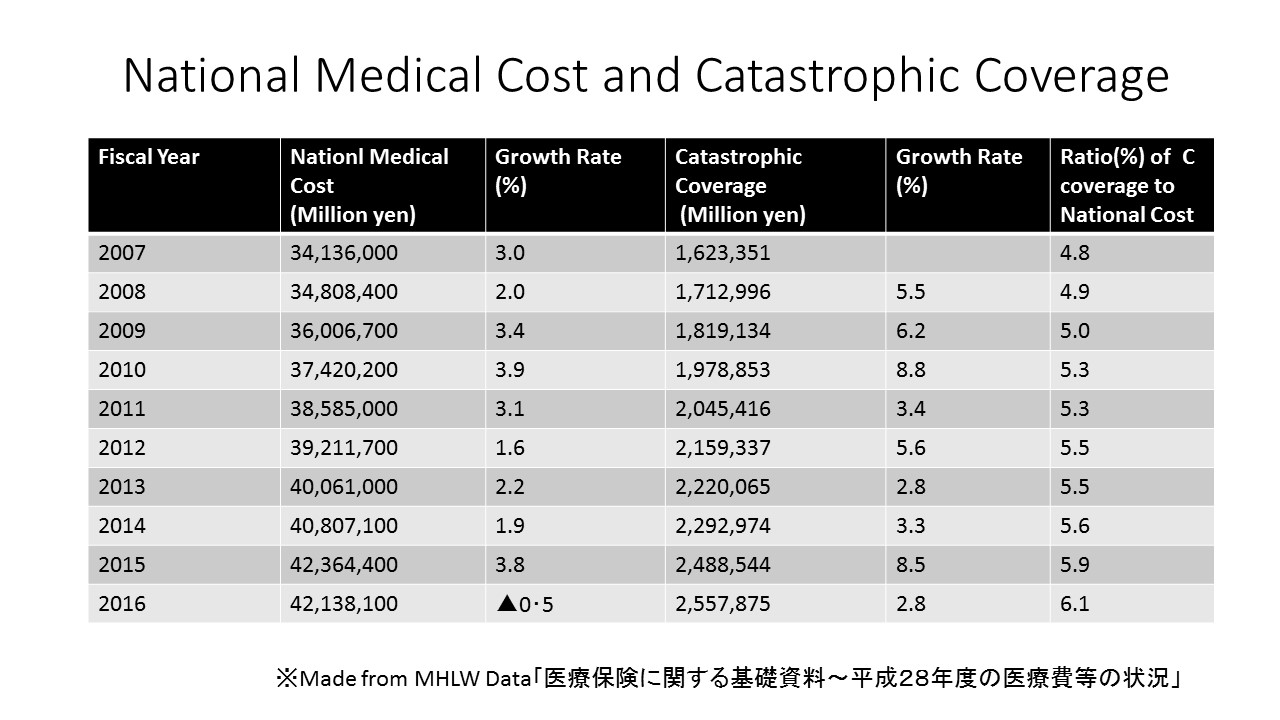

Comparison to Growth of National Medical Expenditure

Japan’s total medical cost is increasing every year. It was 34 trillion yen in 2007; however, the cost swelled to ¥42 trillion in 2016. The total medical cost has increased by 23.4 % within these ten years. If we look at the Catastrophic coverage cost over this same period, it was ¥1.6 trillion in 2007 and grew to ¥2.6 trillion in 2016. The Catastrophic coverage cost increased by 57.6 % over that ten years. The growth rate of the Catastrophic coverage cost is higher than those of the National medical cost. The ratio of Catastrophic coverage to the National medical costs has slightly increased every year. In 2016, the ratio passed 6% for the first time within those ten years -see Table4.(11).

Table 4 National Medical Cost and Catastrophic Coverage Cost

Impact of covering new expensive drugs on the finance of NHI

The National Federation of Health Insurance Societies (NFHIS), which is an association of employment-based health insurance, publishes the top 100 medical bills every year. According to a 2017 report published by this Federation,the most expensive treatment in this year was for a hemophilia patient.(12) The cost of this patient’s treatment was ¥79,157,950. Hemophilia treatments occupied the top 6 most expensive treatments in this report. The number of bills that exceeded ¥10,000,000 in 2017 was 532, which was an increase of 9.9 % from the previous year. In addition, this was the first time in which the number of cases exceeded 500. As the number of bills exceeding ¥10,000,000 was 134 in 2008, the number has increased by four times compared to 10 years ago-see Table5.

Table 5: The number of medical bill which is over ¥10,000,000

The NFHIS explained that three out of the four main reasons why the number of expensive bills has rapidly increased from 2015-2017 was to cover expensive drugs named Temcell HS in 2015, and Sebelipase Alfa Preparation in 2016, and Spinraza Intrathecal injection in 2017. These drugs apply to the treatment of graft-versus-host disease after bone hematopoietic stem cell transplantation, Lysosomal acid lipase LAL, and Spinal muscular atrophy, respectively.

In April 2018, the Health Insurance Committee of the Social Security Council in the MHLW consulted about the application of new medicine to the SHI.(13) The MHLW suggested to the committee that new medicines need to be evaluated based on their cost-effectiveness. The reason why they consulted about the medicine cost was that new and expensive drugs such as “Opzyvo” had an impact on the finance of the SHI. The MHLW explained that new drugs that have developed with the progress of genome analysis technology apply to rare diseases and that the number of patients was limited. However, a drug such as “Opzyvo” which expands target patients will impact the medical cost of the SHI. The MHLW explained that they introduced a system of revising drug prices promptly and the need to evaluate the cost-effectiveness.

Following these results, the government decided in June 2018 that they would consider the cost-effectiveness and a combination of non-insurance medical treatment at the time of covering new drugs and new medical techniques to the SHI.(14) The drug price will be revised every year from 2021, instead of once every two years.(15)

Japan has a great medical system to cover everyone. However, the total annual medical cost of the SHI is over ¥40 trillion and will continue to increase because Japan is under a rapidly aging society. The government has changed slightly the patient’s out of pocket payment, but it is not realistic to increase these fees more because if the patients can’t afford the medical payment, they will end up declining the treatment. This means that the patients may decide not to treat their disease even though medicines or medical techniques are available and covered by the SHI. It might create a social- economic disparity among people. Therefore, the government needs to evaluate cost-effectiveness when it introduces new drugs and techniques. Also, it might work if people pay a little more for a common disease that needs inexpensive drugs. Or it might be effective to introduce a system of reducing polypharmacy. In Hokkaido, a pilot project will start where a pharmacist checks the medicines patients bring from their home and decide whether the patients can still take those medicine or discard them.(16) In the United States, the pharmaceutical company producing “Kymriah” will be reimbursed only when the medicine works effectively after one month.(17) As a result, it is still possible to take measures to make the Japanese Social Health Insurance more sustainable.

References

(1)Asahi Shimbun 5/15/2019 evening edition「白血病新薬の保険適用決定、3349万円 厚労省」

Yomiuri Shimbun 5/15/2019 eveinig edition「白血病新薬 保険適用 中医協了承 薬価最高3349万円」、

(2)Asahi Shimbun 6/24/2018「医療費、支援制度を知って軽減 限度額超で払い戻し、障害年金対象の場合も」、

(3)Ministry of Health,Labour and Welfare「厚生労働省「医療費の一部負担(自己負担)割合について」

(4)Ministry of Health, Labour and Welfare「高額療養費の概要~医療費の一部負担(自己負担)割合について」

(5)Ministry of Health, Labour and Welfare「高額療養費制度を利用される皆さまへ」「高額療養費制度の見直しについて(概要)」

(6)Ministry of Health,Labour, and Welfare 「高額療養費制度の見直し」

(7)Ministry of Health,Labour, and Welfare「高額療養費制度の見直しについて」

(8)Asahi Shimbun 12/15/2016「70歳以上の医療費自己負担上限、こう変わる」

Nikkei Shimbun 12/23/2016「社会保障、踏み込み不足 高齢者も負担増 17年度予算案、年金抜本策は遠く」

(9)Ministry of Health,Labour, and Welfare「高額療養費の現物給付化」

(10)Ministry of Health,Labour, and Welfare「高額な外来診療を受ける皆さまへ」Japan Health Insurance Association「医療費が高額になりそうなとき」

(11)Ministry of Health,Labour, and Welfare「医療保険に関する基礎資料~28年度の医療費等の状況~」

(12)National Federation of Health Insurance Societeis「平成29年度 高額レセプト上位の概要」

(13)Ministry of Health,Labour, and Welfare「医療保険制度に関する主な論点」

(14)Ministry of Health,Labour, and Welfare「新規医薬品等の保険収載の考え方について」

(15)Cabinet Office:Council on Economic and Fiscal Policy「毎年薬価調査・毎年薬価改定について」

(16)Hoddaido Shimbun 7/18/2019「服薬指導で医療費抑制 道が薬剤師会とモデル事業 処方量調整で残薬減へ」

(17)Asahi Shimbun 2/21/2019「難治がん新薬、高額の壁 薬価抑制の前例も キムリア承認へ」

医療ジャーナリスト。札幌市生まれ、ウエスタンミシガン大卒。1992年、北海道新聞社入社。室蘭報道部、本社生活部などを経て、2001年東京支社社会部。厚生労働省を担当し、医療・社会保障問題を取材する。2004年、がん治療と出産・育児の両立のため退社。再々発したがんや2つの血液の難病を克服し、現在はフリーランスで医療問題を中心に取材・執筆している。著書に「がんと生き、母になる 死産を受け止めて」(まりん書房)